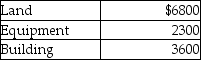

Anderson Corporation has purchased a group of assets for $20,300.The assets and their relative market values are listed below.

Which of the following amounts would be debited to the Land account? (Round any intermediate calculations to two decimal places,and your final answer to the nearest dollar. )

Definitions:

Service-Connected Disabilities

Disabilities that are recognized as being directly related to military service.

Coordination of Benefits (COB)

A process whereby insurance companies share costs and determine payment responsibilities when a person is covered under multiple insurance plans.

Duplication of Payment

The act of making the same payment more than once, often due to administrative error or oversight, leading to unnecessary financial outlay.

Fee-For-Service

Payment for each service that is provided; individuals who choose to pay high premiums so that they have the flexibility to seek medical care from health care professionals of their choice.

Q4: The allowance method of accounting for uncollectible

Q11: Under both the allowance method and the

Q20: On January 1,2017,Apex Solutions paid $200,000 to

Q57: Trading debt investments are categorized as noncurrent

Q88: Factoring occurs when a business sells its

Q126: In counting the number of days in

Q130: Southwest,Inc.records indicate that January sales on account

Q156: For available-for-sale debt investments,state:<br>• Reporting method used<br>•

Q159: When a company uses excess cash to

Q179: Modern Clothing Store reported the following selected