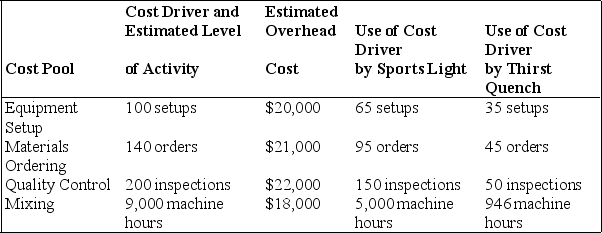

Exhibit 3-1

Hydrate Inc.makes two types of sports drinks and is implementing an activity-based costing system.Previously,all overhead had been applied on the basis of machine hours.The company produces 22,500 units of Sports Light and 42,284 units of Thirst Quench.Additional data is as follows:

-Refer to Exhibit 3-1.What is the total overhead cost for Sports Light using ABC?

Definitions:

Involuntary Conversion

A forced change of property ownership or destruction, such as through theft or natural disaster, that may have tax implications.

Installment Method

is an accounting technique used to recognize revenue and expenses over time as payments are made or received, rather than at the time of transaction.

Basis

The amount of an investment in property for tax purposes; used to calculate gain or loss on a sale or other disposition of the property.

Gain Recognized

The profit realized from the sale or exchange of an asset, which must be reported for tax purposes.

Q4: The units to be produced in the

Q5: The only difference between absorption costing and

Q8: What is the Digger Division's return on

Q14: Unusual data points are often called outliers.

Q24: An advantage of using activity-based costing is

Q31: Which of the following would be a

Q56: Assume you receive $60,000 in five years

Q60: Sandwiches Galore is a small shop looking

Q62: Cost-plus pricing is often used by companies

Q65: Managerial accounting can only use financial performance