Answer the following question(s) using the information below:

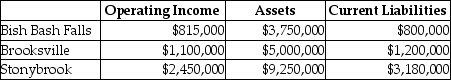

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%,and equity capital that has a market value of $9 million (book value of $5 million) .Coldbrook Company has profit centres in the following locations with the following operating incomes,total assets,and current liabilities.The cost of equity capital is 15%,while the tax rate is 30%.

-What is the for Brooksville?

Definitions:

Futures Contracts

Agreements to buy or sell an asset at a predetermined future date and price.

Spot Price

The present market rate at which a specific asset like a commodity, currency, or security is available for purchase or sale with immediate delivery.

Sale Of Corn

typically refers to the transaction or process of selling the agricultural product corn, which can be influenced by various factors such as market demand, quality, and harvest yield.

Spot Price

The existing market value at which an asset is available for immediate purchase or sale.

Q1: Nonmanufacturing costs include direct labor and indirect

Q13: Vancouver Valley Ltd.has two divisions,Computer Services and

Q30: Adams Company placed $2,000 of direct materials

Q33: What are the Wood Furniture Company annual

Q38: The economic order quantity decision model<br>A)calculates the

Q45: Refer to Exhibit 6-5.What would be the

Q63: Which of the following is the total

Q108: Assume the transfer price for a pair

Q154: After-tax savings from an operating cash inflow

Q156: Post-investment audits<br>A)should be done as soon as