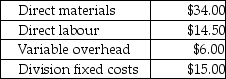

Answer the following question(s) using the information below.Cool Air Ltd.manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division.The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells them to retailers.The Compressor Division "sells" compressors to the Assembly Division.The market price for the Assembly Division to purchase a compressor is $77.(Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units.The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.Compressor's costs per compressor are:

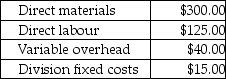

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-What is the transfer price per compressor from the Compressor Division to the Assembly Division if the method used to place a value on each compressor is 150% of variable costs?

Definitions:

Credit Sales

Credit Sales are transactions where the goods or services are provided to the customer with the agreement that payment will be made at a future date.

Effect on Profit

The impact that specific actions or events have on the net income of a company.

Trade Receivables

Amounts owed to a business by its customers following the sale of goods or services on credit.

Q15: The cost per equivalent unit in the

Q32: The Work in Process Inventory account for

Q35: The economic value added concept has attracted

Q38: A Canadian company has subsidiaries in France,England,Canada,and

Q60: What is the transfer price per pair

Q66: What are Wheels's and Assembly's residual incomes

Q70: What is the monthly operating advantage (disadvantage)of

Q78: Coptermagic Company supplies helicopters to corporate clients.Coptermagic

Q133: Relevant cash flows are expected future cash

Q148: Primary components that manufacturers would use to