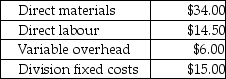

Answer the following question(s) using the information below.Cool Air Ltd.manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division.The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells them to retailers.The Compressor Division "sells" compressors to the Assembly Division.The market price for the Assembly Division to purchase a compressor is $77.(Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units.The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.Compressor's costs per compressor are:

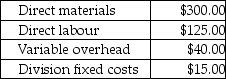

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-What is the transfer price per compressor from the Compressor Division to the Assembly Division if the transfer price per compressor is 110% of full costs?

Definitions:

Machine Milkers

Mechanical devices or systems used to extract milk from dairy animals, such as cows or goats.

Marginal Product

The supplementary production derived by adding one more unit of a particular input, with all else remaining constant.

Labor Hours

The amount of time workers spend on the job, often measured in hours per day, week, or year.

Returns to Scale

The speed at which production levels rise due to a corresponding rise in all contributing factors.

Q1: It is acceptable to allocate selling costs

Q11: Briefly explain each of the four levers

Q21: Current cost return on investment is a

Q27: Which of the following is a product

Q30: Which of the following is typically performed

Q30: A part of a control system that

Q40: River Road Paint Company has two divisions.The

Q44: Which of the following is a period

Q93: Initial machine investment costs include cash outflows

Q114: Clark Industries Ltd.manufactures monochromators that are used