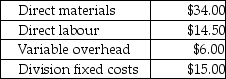

Answer the following question(s) using the information below.Cool Air Ltd.manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division.The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells them to retailers.The Compressor Division "sells" compressors to the Assembly Division.The market price for the Assembly Division to purchase a compressor is $77.(Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units.The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.Compressor's costs per compressor are:

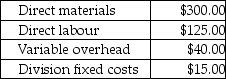

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-Assume the transfer price for a compressor is 150% of total costs of the Compressor Division and 1,000 of the compressors are produced and transferred to the Assembly Division.The Compressor Division's operating income is

Definitions:

Legal Obligation

A duty enforced by law, requiring an individual or organization to conform to a certain standard of conduct.

CD Of The Month Club

A subscription service that sends members a new compact disc, usually focused on a particular genre or theme, every month.

Consideration Issue

A concept in contract law referring to the requirement that both parties exchange something of value for a contract to be enforceable.

Off-Duty Police Officer

A law enforcement officer who is not currently engaged in their official duties or responsibilities.

Q22: All of the following are general methods

Q22: Clock Manufacturing Company purchased a new piece

Q26: Samuel Manufacturing Inc.is evaluating new machinery in

Q27: Which of the following is a product

Q31: An important component in several of the

Q50: When direct materials are placed into production,their

Q57: Refer to Exhibit 3-3.Using the direct method

Q58: Which of the following is NOT a

Q87: Physical exertion and mental action towards a

Q113: Which of the following factor(s)would cause an