Hendricks Ltd.of Calgary manufactures and sells computers.The Manufacturing Division is located in China and transfers 75% of its output to the Assembly Division in the Philippines.The balance of the product is sold in the local market at 2,100 yuan/unit.The Philippines division sells 20% of its output in the local market at 31,500 pesos/unit,with the balance shipped to Calgary.The Calgary operation packages the units and sells the final product at $1,900 Canadian per unit.

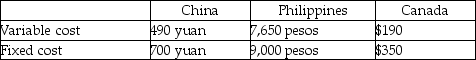

The following budget data are available:

Exchange rates are: $1 Canadian = 7 yuan and $1 Canadian = 45 pesos

Tax rates are 45% in China,20% in the Philippines and 40% in Canada.Income taxes are not included in the calculation of cost-based transfer prices.Assume that Hendricks does not pay Canadian tax on amounts already taxed in foreign jurisdictions.Take each calculation to 2 decimal places.

Required:

The company has determined that it may transfer units at 250% of variable cost or at market and comply with all existing tax legislation.Which transfer pricing method should the company pursue? Support your recommendation with appropriate calculations.

Definitions:

Favorably Inclined

Having a positive attitude or disposition towards something or someone.

Intimate Space

A spatial zone up to two feet, about an arm’s length, from a person’s body that is reserved for close friends and loved ones.

Endearing

Having qualities that make someone or something lovable or attract positive feelings.

Decoding Process

Receipt and translation of information by the receiver.

Q3: Refer to Exhibit 3-1.Using ABC,what is the

Q6: Which of the following is not a

Q15: Which of the following statements best describes

Q33: The term "factory burden" is synonymous with

Q34: A management control system should have all

Q43: What is the transfer price per kilogram

Q45: The use of an accelerated method of

Q69: Organizations can allocate overhead in a variety

Q103: Which of the following can be used

Q108: The acquisition cost of the assets in