Answer the following questions using the information below:

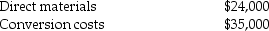

The Rest-a-Lot chair company manufacturers a standard recliner.During February, the firm's Assembly Department started production of 75,000 chairs.During the month, the firm completed 80,000 chairs, and transferred them to the Finishing Department.The firm ended the month with 10,000 chairs in ending inventory.There were 15,000 chairs in beginning inventory.All direct materials costs are added at the beginning of the production cycle and conversion costs are added uniformly throughout the production process.The FIFO method of process costing is used by Rest-a-Lot.Beginning work in process was 30% complete as to conversion costs, while ending work in process was 80% complete as to conversion costs.Beginning inventory:

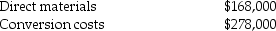

Manufacturing costs added during the accounting period:

Manufacturing costs added during the accounting period:

-What is the Rest-a-Lot company amount of direct materials cost assigned to ending work-in-process inventory at the end of February?

Definitions:

Business Cycle Management

The practice of adjusting strategies and operations of a company in anticipation of or in response to economic expansions and contractions.

Customer Relationship Management

A strategy for managing a company's interactions with current and potential customers, typically involving the use of technology to organize, automate, and synchronize sales, marketing, customer service, and technical support.

Supply Chain Management

The coordinating and managing of all activities involved in sourcing, procurement, conversion, and logistics management of products.

Computerized System

An electronic system that uses computers and software to manage, control, or perform a task or process.

Q20: The Arvid Corporation manufactures widgets,gizmos,and turnbols from

Q21: Krum Lawn Equipment has five departments,of which

Q49: Ford Motor Company is said to use

Q62: Which of the following statements is FALSE?<br>A)The

Q69: The fixed and variable costs allocated to

Q87: Morrissette Ltd.sells 240,000 units a year.Its carrying

Q98: Unfavourable variances reveal not only what occurred

Q106: Hawthorne Ltd.purchases 1,500,000 units of its product

Q123: If a dual-rate cost allocation method is

Q129: Lexington Company produces baseball bats and cricket