Answer the following questions using the information below:

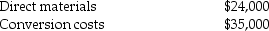

The Rest-a-Lot chair company manufacturers a standard recliner.During February, the firm's Assembly Department started production of 75,000 chairs.During the month, the firm completed 80,000 chairs, and transferred them to the Finishing Department.The firm ended the month with 10,000 chairs in ending inventory.There were 15,000 chairs in beginning inventory.All direct materials costs are added at the beginning of the production cycle and conversion costs are added uniformly throughout the production process.The FIFO method of process costing is used by Rest-a-Lot.Beginning work in process was 30% complete as to conversion costs, while ending work in process was 80% complete as to conversion costs.Beginning inventory:

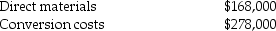

Manufacturing costs added during the accounting period:

Manufacturing costs added during the accounting period:

-What is the Rest-a-Lot company cost of the goods transferred out during February?

Definitions:

Business Combination

A transaction or event in which an acquirer obtains control of one or more businesses, often involving mergers, acquisitions, or consolidations.

Pooling-of-interests Method

A merger accounting method in which the assets and liabilities of merging companies are combined using book values, rather than the purchase method.

Statutory Amalgamation

A merger or combination of two or more companies into a new entity, governed and approved by a legal statute.

Reverse Takeover

A scenario where a smaller or a privately-held company takes over a larger or publicly-traded company, often to bypass the lengthy and complex process of going public.

Q17: The costs of abnormal spoilage are written

Q53: If joint products end up with the

Q56: Marvelous Motors is a small motor supply

Q60: There are no logical reasons for allocating

Q64: The sales-quantity variance is favorable when budgeted

Q78: The Zygon Corporation was recently formed to

Q110: A project's net present value is increased

Q122: Benefits of the dual-rate method include<br>A)variable costs

Q126: When retailers are uncertain about demand for

Q162: What is present value of the salvage