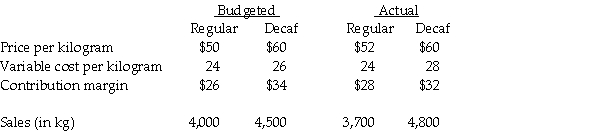

Columbia Coffee Inc.sells two types of coffee,Regular and Decaf.The monthly budget for Canadian coffee sales is based on a combination of last year's performance,a forecast of industry sales,and the company's expected share of the Canadian market.The following information is provided for March:

Budgeted fixed costs are $58,000.Actual fixed costs are $62,000.

Required:

Calculate the static-budget,flexible-budget and sales-volume variances for the contribution margin,for the company for March.

Definitions:

Constructive Receipt

This refers to the point at which an individual has access to, or control over, income, thus making it taxable, even if the income has not been physically received.

Compensation

Payment or salary received for services rendered or work done.

Exempt From Income

Income that is not subject to taxation under federal or state law.

Workers' Compensation Payments

Benefits provided to employees suffering from work-related injuries or illnesses, covering medical expenses and lost wages.

Q23: Yip Manufacturing purchases trees from Cheney Lumber

Q24: If a dual-rate cost-allocation method is used,what

Q26: Using the stand-alone method with physical units

Q56: What are the Waldorf Computer Systems Inc.respective

Q91: _ is an organization's ability to achieve

Q95: Required:<br>a.What amount is the revenue effect of

Q104: Boss Manufacturing generally has spoiled goods during

Q113: Which statement is NOT true regarding the

Q132: Using the NRV method,the amount of joint

Q137: Spoilage can be a significant cost for