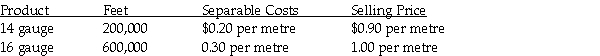

AllCanada Wire Products processes copper into wire.It makes 12 gauge and 14 gauge wire.During April the joint costs of processing the aluminium were $365,000.There were no beginning or ending inventories for the month.Production and sales value information for the month were as follows:

Required:

Determine the amount of joint costs allocated to each product if the constant gross margin percentage of NRV method is used.

Definitions:

Current Liabilities

Obligations or debts that a company must pay within one year or within the normal operating cycle.

Federal Depository Bank

A financial institution that is authorized to hold deposits for the Federal Reserve System and process related transactions.

Payroll Taxes

Taxes imposed on employers and employees, calculated as a percentage of the salaries that employers pay their staff, including social security and Medicare taxes in the United States.

Contingent Liabilities

Potential financial obligations that may occur depending on the outcome of a future event.

Q23: Accounting for rework in process-costing requires that

Q24: The first-in,first-out (FIFO)process costing method assigns the

Q46: What is the Ferryman Products full product

Q59: When using the causality criterion,cost drivers are

Q92: The costs of production that yield multiple

Q93: Regardless of whether previous departments used the

Q95: Fixed cost allocation rates should be determined

Q109: New Image Sports uses a process costing

Q118: Creative Colors Paint Company placed 315,000 litres

Q150: Reverse engineering has the objective of reducing