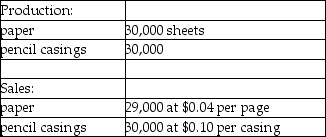

Use the information below to answer the following question(s) .Raynor Manufacturing purchases trees from Tree Nursery and processes them up to the splitoff point, where two products (paper and pencil casings) are obtained.The products are then sold to an independent company that markets and distributes them to retail outlets.The following information was collected for the month of October.Trees processed:

50 trees (yield is 30,000 sheets of paper and 30,000 pencil casings and no scrap)

Cost of purchasing 50 trees and processing them up to the splitoff point to yield 30,000 sheets of paper and 30,000 pencil casings is $1,500.Raynor Manufacturing's accounting department reported no beginning inventories; however, ending inventory amounts reflected 1,000 sheets of paper in stock.

Cost of purchasing 50 trees and processing them up to the splitoff point to yield 30,000 sheets of paper and 30,000 pencil casings is $1,500.Raynor Manufacturing's accounting department reported no beginning inventories; however, ending inventory amounts reflected 1,000 sheets of paper in stock.

-What is the approximate cost assigned to the pencil casings if joint costs are allocated using the sales value at splitoff method?

Definitions:

Experimental Situation

A controlled environment or setup created to investigate the effects of variables on subjects in a scientific study.

Frame of Reference

A set of criteria or stated values in relation to which measurements or judgments can be made.

Asch's Study

Asch's study refers to a series of psychological experiments conducted by Solomon Asch in the 1950s, demonstrating the power of conformity in groups.

Group Pressure

The influence exerted by a group on individual members to align their thoughts, feelings, or behaviors with group norms or expectations.

Q5: Partial productivity equals quantity of output produced

Q12: Using the NRV method,the amount of joint

Q31: Using the physical measures method,the weightings for

Q45: An activity-based costing system may focus on

Q49: Ford Motor Company is said to use

Q54: Bannock Safety Equipment Ltd.operates two stores,one in

Q74: The Omega Corporation manufactures two types of

Q83: Germaine Company provided the following information.<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2723/.jpg"

Q109: The weighted average method of process costing

Q114: Locked-in costs are costs that have been