Answer the following question(s) using the information below:

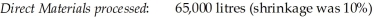

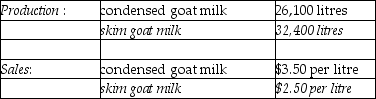

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result.The following information was collected for the month of October:

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre.Xyla can be sold for $18 per litre.Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50.The product can be sold for $9 per litre.There are no beginning and ending inventory balances.

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre.Xyla can be sold for $18 per litre.Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50.The product can be sold for $9 per litre.There are no beginning and ending inventory balances.

-Using estimated net realizable value, what amount of the $72,240 of joint costs would be allocated Xyla and the skim goat ice cream?

Definitions:

Fovea

A small depression in the retina where visual acuity is highest.

Astigmatism Test Chart

A visual tool used to assess the presence and degree of astigmatism, featuring lines or patterns to help determine visual distortions.

Hyperopic

Referring to farsightedness, a common vision condition where distant objects can be seen clearly, but close ones do not come into proper focus.

Myopic

Nearsightedness; a condition in which close objects appear clearly but distant ones don't.

Q3: Steven Corporation manufactures fishing poles that have

Q4: Using the incremental method,what amount of revenue

Q8: For each of the following methods of

Q64: What is the target cost if operating

Q68: Hunt Company and Indio Company are noncompeting

Q75: What amount of direct materials costs are

Q95: Which of the following is TRUE regarding

Q110: Using the step-down method,what amount of Maintenance

Q138: When a single manufacturing process yields two

Q147: Referring to Barry Company,which of the following