Answer the following question(s) using the information below:

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result.The following information was collected for the month of October:

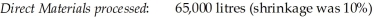

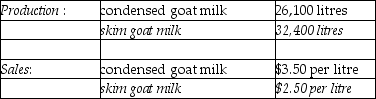

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre.Xyla can be sold for $18 per litre.Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50.The product can be sold for $9 per litre.There are no beginning and ending inventory balances.

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre.Xyla can be sold for $18 per litre.Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50.The product can be sold for $9 per litre.There are no beginning and ending inventory balances.

-What is the reason that accountants do not like to carry inventory at net realizable value?

Definitions:

Eating Behavior

The patterns of dietary practices, choices, and habits of an individual or group, including what, when, where, and why people eat.

Physiological Response

The body's automatic reactions to external stimuli, including changes in metabolism, heart rate, and muscle tension.

Breathing Exercises

Techniques aimed at improving respiratory function or reducing stress by consciously controlling the breath.

Cue Management

Techniques aimed at controlling environmental or psychological triggers that influence behavior.

Q16: In each of the following industries,identify possible

Q34: Which of the following is the correct

Q38: Robotoys Incorporated manufactures and distributes small robotic

Q75: Which of the following actually calculates the

Q77: Which of the following journal entries properly

Q81: What is Acorn's target selling price if

Q100: Robert's Medical Equipment Company manufactures hospital beds.Its'

Q130: What is the total amount debited to

Q135: What is the full cost of the

Q158: Required:<br>Present the following,<br>a.The change in operating income