Answer the following question(s) using the information below:

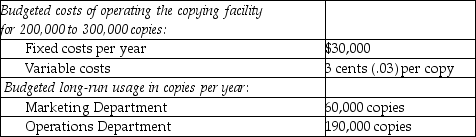

The Bonawitz Corporation has a central copying facility.The copying facility has only two users, the Marketing Department and the Operations Department.The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Marketing Department was 40,000 copies and by the Operations Department was 180,000 copies.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Marketing Department was 40,000 copies and by the Operations Department was 180,000 copies.

-If a single-rate cost allocation method is used, what amount of copying facility costs will be budgeted for the Marketing Department?

Definitions:

Sensitivity Analysis

Sensitivity Analysis is a financial modeling tool used to determine how different values of an independent variable affect a particular dependent variable under a given set of assumptions.

Expected Value Analysis

A statistical technique used to predict the likely outcome of a decision or series of actions by considering all possible scenarios and their probabilities.

Capital Rationing

The act of placing restrictions on the amount of new investments or projects a company may undertake, often due to limited resources such as capital.

Present Value Concepts

The idea that an amount of money today is worth more than the same amount in the future due to its potential earning capacity, often calculated through discounting future cash flows.

Q11: Valley West Amusement Park is evaluating its

Q18: Do-It Company manufactures sinker molds for fishing.A

Q40: The president's salary,interest on corporate debt and

Q50: A company uses a long-run time horizon

Q55: What method is used when joint costs

Q71: What is the Machining Department's allocation of

Q81: Sweet Sugar Company processes sugar beets into

Q100: The cost NOT relevant for this decision

Q130: Muskoka Travel offers guided tours through the

Q142: Kezer Crafts currently sells motor boats for