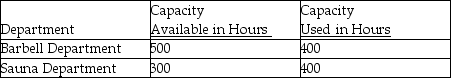

Use the information below to answer the following question(s) .We Be Warehouse Fitness Equipment incurred $80,000 of common fixed costs and $120,000 of common variable costs.Data are provided below for the capacity allowed and the capacity used.  For both departments, common fixed costs are to be allocated on the basis of capacity available and common variable costs are to be allocated on the basis of capacity used.

For both departments, common fixed costs are to be allocated on the basis of capacity available and common variable costs are to be allocated on the basis of capacity used.

-Assuming that fixed and variable costs are allocated according to capacity used then the fixed and variable costs allocated to the Barbell Department will be

Definitions:

Direct Labor Hours

The total hours worked by employees directly involved in the production process, used in calculating cost allocations and efficiency.

Allocation Base

A criterion or measure used for distributing or apportioning costs among various cost objects in a fair, equitable, and rational manner.

Plantwide Overhead Rate Method

A cost accounting method that applies a single overhead rate to all units produced across different departments or processes in a facility.

Cost Pools

A grouping of individual costs from which cost allocations are made later, used to distribute expenses in cost accounting practices.

Q1: Explain the difference between locked in costs

Q3: What is the total sales-mix variance in

Q21: Using the incremental method for revenue allocation,what

Q68: Explain the product differentiation and the cost

Q75: Which of the following actually calculates the

Q90: Which of the following BEST describes the

Q118: What is the company's market-size variance?<br>A)$4,800 favourable<br>B)$3,200

Q133: The reciprocal allocation method does not incorporate

Q134: Calamata Corporation processes a single material into

Q143: What is the target operating income?<br>A)$240,000<br>B)$360,000<br>C)$200,000<br>D)$192,000<br>E)$400,000