Use the information below to answer the following question(s).

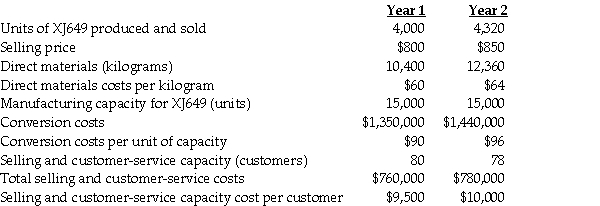

Following a strategy of product differentiation,Ernsting Ltd.makes high quality electronic components.Ernsting Ltd.presents the following data for the past two years relating to its XJ649 product.

Ernsting produces no defective units but it wants to reduce direct materials usage per unit in Year 2 .Manufacturing conversion costs in each year depend on production capacity defined in terms of units that can be produced.Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support.Neither conversion costs nor customer-service costs are affected by changes in actual volume.Ernsting has 60 customers in Year 1 and 66 customers in Year 2.The industry market size for the product increased 6% from Year 1 to Year 2.Of the $50 increase in unit selling price,$30 is attributable to a general price increase.

Ernsting produces no defective units but it wants to reduce direct materials usage per unit in Year 2 .Manufacturing conversion costs in each year depend on production capacity defined in terms of units that can be produced.Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support.Neither conversion costs nor customer-service costs are affected by changes in actual volume.Ernsting has 60 customers in Year 1 and 66 customers in Year 2.The industry market size for the product increased 6% from Year 1 to Year 2.Of the $50 increase in unit selling price,$30 is attributable to a general price increase.

-Required:

Present the following,

a.The change in operating income from cost leadership.

b.The change in operating income due to industry wide effects.

c.The effect of product differentiation on operating income and a summarization of the change in operating income between Year 1 to Year 2.

Definitions:

FUTA

The Federal Unemployment Tax Act (FUTA) is a United States federal law that imposes a payroll tax on employers to fund state workforce agencies and unemployment insurance.

Medicare Taxes

Taxes that fund Medicare, a federal health insurance program, deducted from the paychecks of employees and also paid by employers.

Wages

Wages refer to the monetary compensation paid by an employer to an employee in exchange for work performed.

Withholding Allowances

A number that employees claim on their W-4 form that reduces the amount of federal income tax withheld from their wages, based on their personal circumstances.

Q6: Required:<br>a.What is the operating income for Year

Q6: If a single-rate cost allocation method is

Q11: Econ Services has requested your services in

Q32: One problem with the physical measure method

Q48: What is product X's approximate gross margin

Q73: What is the Luke Company's operating income

Q94: An organization that is using the cost

Q115: The managers of the production department have

Q135: Required:<br>a.What is the operating income for Year

Q157: What is Product X's approximate production cost