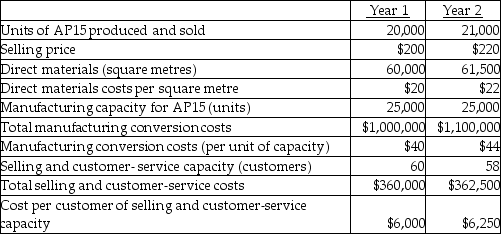

Use the information below to answer the following question(s) .Following a strategy of product differentiation, Luke Company makes a high-end Appliance, AP15.Luke Company presents the following data for the years 1 and 2.  Luke Company produces no defective units but it wants to reduce direct materials usage per unit of AP15 in year 2.Manufacturing conversion costs in each year depend on production capacity defined in terms of AP15 units that can be produced.Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support.Neither conversion costs or customer-service costs are affected by changes in actual volume.Luke Company has 46 customers in year 1 and 50 customers in year 2.The industry market size for high-end appliances increased 5% from year 1 to year 2.

Luke Company produces no defective units but it wants to reduce direct materials usage per unit of AP15 in year 2.Manufacturing conversion costs in each year depend on production capacity defined in terms of AP15 units that can be produced.Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support.Neither conversion costs or customer-service costs are affected by changes in actual volume.Luke Company has 46 customers in year 1 and 50 customers in year 2.The industry market size for high-end appliances increased 5% from year 1 to year 2.

-What is the Luke Company's revenue effect of price-recovery component?

Definitions:

Low-Cost Strategy

A business strategy aimed at becoming the lowest-cost producer in the industry or market, thereby allowing the company to offer its products or services at lower prices than competitors.

Focused Strategy

A strategy utilized by companies to focus on a particular market segment or demographic, offering customized products or services.

Organization Design

The creation of roles, processes, and formal reporting relationships in an organization to achieve its goals and objectives.

Differentiation

The process of distinguishing or creating differences between products, services, or concepts to make them more appealing to specific target markets.

Q15: Uncertainty refers to the possibility that an

Q17: What is the Barry Company's operating income

Q33: Linear programming is a tool that maximizes

Q46: The second-ranked cost object is termed the

Q48: The single-rate method is when all indirect

Q62: The incremental common cost allocation method requires

Q107: It is easier to cost inventory if

Q124: In general,profit potential increases with greater competition,stronger

Q128: To execute the company strategy,measures on the

Q141: Past costs that are unavoidable and unchangeable