Use the information below to answer the following question(s) .

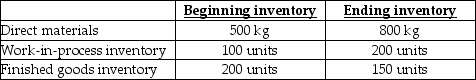

Samson Inc.expects to sell 10,000 barbells for $18.00 each.Direct materials costs are $5.00,direct manufacturing labour is $6.00,and manufacturing overhead is $2.50 per barbell.Each barbell requires 6 kilograms (kg) of material which is all added at the start of production.The units in work-in-process beginning and ending inventory were half complete as to direct labour and manufacturing overhead costs;the units in beginning inventory are completed before new units are started..Each barbell requires one-quarter hour of direct labour,and manufacturing overhead is allocated based on direct labour hours.Marketing costs are $2.00 per barbell.The following inventory levels are expected to apply to 2016:

-How many kilograms of material will need to be purchased for 2016 production and inventory requirements?

Definitions:

Initial Value Method

An accounting practice for investment recording wherein the investment is kept at its original cost on the balance sheet without adjusting for changes in net income of the investee.

Dividends

Earnings disbursed by a company to its shareholders, generally as a sharing of profits.

Net Income

The total profit or loss of a company after all revenues, costs, and expenses have been accounted for, typically reported at the bottom of the income statement.

Annual Amortization

The process of spreading out a loan or intangible asset's cost over its useful life, reflecting each year’s expense on the financial statements.

Q2: Using a broad average to allocate costs

Q24: Calculate the efficiency variance for variable setup

Q25: Provide examples of three companies that would

Q42: In a job cost system,the cost object

Q75: When benchmarking<br>A)the best levels of performance are

Q88: Variances sometimes signal to managers that their

Q107: What is the variable manufacturing overhead efficiency

Q127: An ABC system results in a better

Q133: A cost accounting system should be revised

Q138: If unit sales exceed the break-even point