Use the information below to answer the following question(s) .

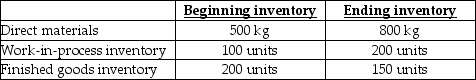

Samson Inc.expects to sell 10,000 barbells for $18.00 each.Direct materials costs are $5.00,direct manufacturing labour is $6.00,and manufacturing overhead is $2.50 per barbell.Each barbell requires 6 kilograms (kg) of material which is all added at the start of production.The units in work-in-process beginning and ending inventory were half complete as to direct labour and manufacturing overhead costs;the units in beginning inventory are completed before new units are started..Each barbell requires one-quarter hour of direct labour,and manufacturing overhead is allocated based on direct labour hours.Marketing costs are $2.00 per barbell.The following inventory levels are expected to apply to 2016:

-On the 2016 budgeted income statement,what amount will be reported for cost of goods sold?

Definitions:

Q14: What are the 2015 budgeted costs for

Q17: What is the variable overhead rate variance?<br>A)$11,000

Q32: Using activity-based costing to allocate overhead costs,what

Q39: The master budget reports a large amount

Q48: What is Regal Company's budgeted fixed overhead

Q82: Effective planning of variable overhead costs means

Q119: How many dresses are sold when operating

Q133: In going from the sales budget to

Q135: Actual costing allocates indirect costs based on

Q144: The chapter shows that variance analysis of