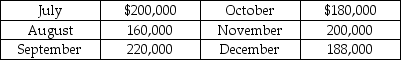

Use the information below to answer the following question(s) .Gold Corporation has the following sales budget for the last six months of 2019:

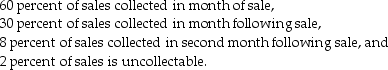

Historically, the cash collection of sales has been as follows:

Historically, the cash collection of sales has been as follows:

-The cash budget is a schedule of expected cash receipts and disbursements that

Definitions:

Operating Activities

Transactions related to the primary activities of a business, such as selling goods and services, which are reflected in the cash flow statement.

Financing Adjustments

Changes made to financial statements to account for the costs and effects of financing activities, such as interest expenses and loan payments.

Common Stock

Equity ownership in a corporation, with voting rights and a residual claim on corporate earnings.

Treasury Stock

Stock that has been issued but has been bought back by the corporation or received as a gift.

Q11: In a cost system that doe not

Q11: Planning the performance of the organization,providing a

Q24: Calculate the efficiency variance for variable setup

Q39: Explain why there is no efficiency variance

Q70: Calculate the production-volume variance for fixed setup

Q81: A hospital receives $1,000,000 monthly in funding

Q88: Non-financial performance measures<br>A)vary from industry to industry.<br>B)include

Q107: Target net income is computed by multiplying

Q154: How much cash will be paid to

Q156: Blankinship,Inc. ,sells a single product.The company's most