Cocoa Pet Corporation manufactures two models of grooming stations,a standard and a deluxe model.

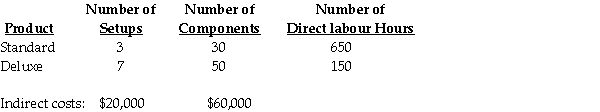

The following activity and cost information has been compiled:

Required:

Assume a traditional (simple)costing system applies the $80,000 of overhead costs based on direct labour hours.

a.What is the total amount of overhead costs assigned to the standard model?

b.What is the total amount of overhead costs assigned to the deluxe model?

Assume an activity-based costing system is used and that the number of setups and the number of components are identified as the activity-cost drivers for overhead.

c.What is the total amount of indirect costs assigned to the standard model?

d.What is the total amount of indirect costs assigned to the deluxe model?

e.Explain the difference between the costs obtained from the traditional costing system and the ABC system.Which system provides a better estimate of costs? Why?

Definitions:

Adulthood

The period in a person's life following the achievement of physical and psychological maturity.

Identity Status

A concept in psychology that describes the level of exploration and commitment individuals have made toward identity formation in various life areas.

Passive Role

A situation or condition in which an individual does not actively contribute to the process or outcome, but instead receives or is affected by actions initiated by others.

Sensory Functioning

The ability of an organism to receive and process sensory information from the environment through sight, hearing, touch, taste, and smell.

Q15: Heady Company sells headbands to retailers for

Q26: Pennsylvania Valve Company makes three types of

Q26: With simple costing systems,products manufactured in small

Q33: The previous controller at the transportation company

Q49: Simple cost systems distort product costs because<br>A)they

Q81: Do activity-based costing systems always provide more

Q100: Describe the four types of responsibility centres.Give

Q101: One of the criticisms of traditional budgeting

Q108: Saskatchewan Industries Inc.had the following account balances

Q113: When making net income evaluations,CVP calculations for