Rogers Printing Ltd.has contracts to complete weekly supplements required by its' customers.For the current year,manufacturing overhead cost estimates total $580,000 for an annual production capacity of 14,500,000 pages.

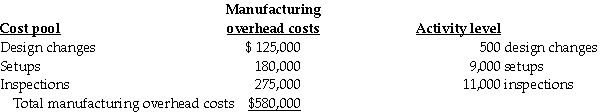

Rogers Printing decided to evaluate the use of additional cost pools.After analyzing manufacturing overhead costs,it was determined that number of design changes,setups,and inspections are the primary manufacturing overhead cost drivers.The following information was gathered during the analysis:

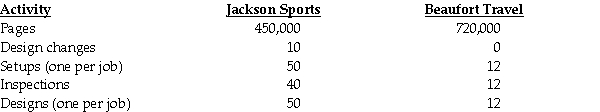

Two customers,Jackson Sports and Beaufort Travel,are expected to use the following printing services:

Pages are a direct cost at $0.02 per page.Design costs per job average $1,500 and $1,700 for Jackson Sports and Beaufort Travel,respectively.Rogers Printing sets prices at $0.11 per page plus 120% of design costs.

Assume that all costs are variable.

Required:

Prepare income statements in contribution margin format for both customers using:

a.Traditional (simple)costing with overhead applied on a page capacity basis

b.Activity-based costing

c.How much a page should Jackson Sports be charged if Rogers Printing wants to breakeven on this customer? Assume that manufacturing overhead costs are fixed and that they are allocated to customers based on pages sold as a percentage of production capacity;and,that design costs are also fixed.

Definitions:

Preferred Mix

The optimal combination of goods and services chosen by an individual or firm based on preferences, income, and prices.

Productive Efficiency

Achieved when goods or services are produced at the lowest possible cost and utilizing resources in the best way possible.

Average Total Cost

The total cost of production divided by the quantity of output produced, showing the average cost per unit.

Technological Advance

Progress in technology that often leads to improvements in efficiency, productivity, and the development of new products.

Q18: Benchmarking key activities can be even more

Q20: The direct-labour efficiency variance for the month

Q23: Performance reports for responsibility centres may include

Q25: Assuming activity-cost pools are used,what are the

Q73: What are the fixed costs per unit

Q94: What should be the number of futons

Q100: All-Green Company has traditionally used only financial

Q127: Maddow Manufacturing is a small textile manufacturer

Q128: The cost driver of an indirect cost

Q129: Classifying a cost as either direct or