Use the information below to answer the following question(s) .

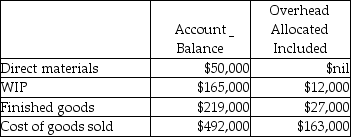

Because the Beckworth Company used a budgeted indirect cost allocation rate for its manufacturing operations,the amount allocated ($190,000) was different from the actual amount incurred ($175,000) .These were the respective ending balances in the Manufacturing Overhead Allocated and Manufacturing Overhead control accounts.

Before disposition of under/overallocated overhead,the following information was available:

-What is the journal entry Beckworth Company should use to write-off the difference between allocated and actual overhead using the proration approach based on overhead allocated?

Definitions:

Limited Partner

An investor in a partnership who has limited liability to the extent of their investment in the partnership and does not participate in daily business operations.

Dissolve

The process of formally closing or ending a legal entity, such as a corporation or partnership, and distributing its assets.

Partnership

A legal form of business operation between two or more individuals who share management and profits or losses.

Operating Agreement

An operating agreement is a legal document outlining the governance and business operations of an LLC (Limited Liability Company).

Q20: Output unit-level cost is identical to batch-level

Q24: There are many aspects of a company

Q25: The Franscioso Company contribution margin ratio is<br>A)1.102:1.<br>B)1.425:1.<br>C)0.298:1.<br>D)0.637:1.<br>E)0.702:1.

Q27: A local financial consulting firm employs 30

Q74: A unit cost is computed by dividing

Q104: Output unit-level costs cannot be determined unless

Q105: Calculate this year's operating income if the

Q137: To calculate the break-even point in a

Q138: Line management is directly responsible for attaining

Q145: Popcorn Inc.currently sells plain popcorn at the