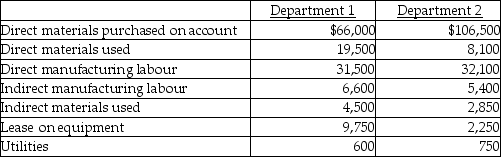

Use the information below to answer the following question(s) .Jim's Computer Products manufactures keyboards for computers.In June, the two production departments had budgeted allocation bases of 10,000 machine hours in Department 1 and 5,000 direct manufacturing labour hours in Department 2.The budgeted manufacturing overheads for the month were $34,500 and $37,500, respectively.For Job 501, the actual costs incurred in the two departments were as follows:

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2.The company uses a budgeted departmental overhead rate for applying overhead to production.

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2.The company uses a budgeted departmental overhead rate for applying overhead to production.

-What is the budgeted indirect cost allocation rate for Department 2?

Definitions:

Promissory Note

A financial instrument in which one party promises in writing to pay a determinate sum of money to the other, either at a fixed or determinable future time or on demand.

Maturity Date

The date on which a financial obligation is due to be paid, such as the final payment date of a loan or bond.

Credit Sale

A sales transaction in which the amount due is not paid at the time of sale but is promised to be paid in the future by the purchaser.

Accounts Receivable

Money owed to a business by its clients or customers for goods or services delivered or used but not yet paid for.

Q11: Last week Job # WPP 298 was

Q17: Boone Hobbies budgeted purchases for next month

Q48: Which of the following is NOT a

Q72: Provided a single allocation base is used,jobs

Q85: Which one of the following is a

Q110: Which of the following statements about benchmarks

Q114: Customers are demanding that companies use the

Q133: Performance variance analysis can be used in

Q148: Budgeting is done in place of "strategic

Q167: Manufacturing overhead includes<br>A)corporate insurance cost.<br>B)the executive officers'