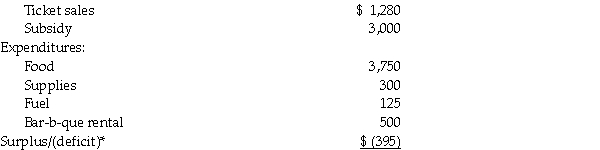

The parent group of the local university football team organizes an end of training camp bar-b-que dinner each year.The 110 player roster and 12 coaches eat for free,and ticket sales are used along with a fixed amount subsidy to fund the event.Last season 250 meals were produced and served.The following financial statement was prepared by one of the team parents:

Revenue:

* The deficit was covered by a one-time donation from a parent whose son graduated and is consequently no longer on this years team.

Required:

Calculate the price per ticket that must be charged to breakeven based on the following assumptions:

- the number of players and coaches meals remain the same,but the number of meals sold increases by 20

-the fixed costs are the same as last year

-the variable costs per unit are the same as last year

-the subsidy will remain at $3,000

Definitions:

Net Income

The total profit or loss of a company after all revenues, expenses, taxes, and costs have been subtracted.

Financial Statements

Reports that summarize the financial performance and position of a business, including the balance sheet, income statement, and cash flow statement.

Accrued Revenues

Revenues earned but not yet received in cash or recorded at the statement date, often recognizing revenue before the payment is received.

Financial Statements

Financial Statements are formal records of the financial activities and position of a business, person, or other entity, presented in a structured manner.

Q7: What is the total manufacturing cost of

Q14: If a C corporation has taxable income

Q41: Describe the concept of kaizen budgeting.

Q75: Managers typically receive reports on cost planning

Q75: Actual costing systems are commonly found in

Q95: Changes in particular cost drivers automatically result

Q100: Describe the four types of responsibility centres.Give

Q104: Place the following steps in the order

Q107: What is the budgeted net operating income

Q161: The total of the costs assigned to