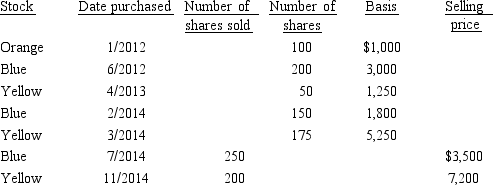

Omar has the following stock transactions during 2014:

a.What is Omar's recognized gain or loss on the stock sales if his objective is to minimize the recognized gain and to maximize the recognized loss?

b.What is Omar's recognized gain or loss if he does not identify the shares sold?

Definitions:

Book Value

The net value of a company's assets less its liabilities and preferred stock, often used to estimate the company's worth.

Yearly Expense

The total amount of money spent by a business or individual over the course of a year, including operational, administrative, and living expenses.

Old Equipment

Machinery or tools that have been used for a long period and may be outdated or less efficient compared to newer versions.

Calculate

Calculate involves using mathematical or statistical methods to determine or assess a particular value, quantity, or outcome based on given data or parameters.

Q4: Shari exchanges an office building in New

Q4: If the special election under § 83(b)is

Q21: The basis of personal use property converted

Q32: When an individual taxpayer has a net

Q47: Which of the following events causes the

Q52: How can an AMT adjustment be avoided

Q53: Barb borrowed $100,000 to acquire a parcel

Q55: Short-term capital losses are netted against long-term

Q77: Laura Corporation changed its tax year-end from

Q84: Quinn,who is single and lives alone,is physically