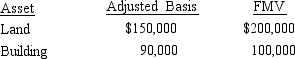

On September 18,2014,Jerry received land and a building from Ted as a gift.Ted had purchased the land and building on March 5,2011,and his adjusted basis and the fair market value at the date of the gift were as follows:

Ted paid no gift tax on the transfer to Jerry.

Ted paid no gift tax on the transfer to Jerry.

a.Determine Jerry's adjusted basis and holding period for the land and building.

b.Assume instead that the FMV of the land was $89,000 and the FMV of the building was $60,000.Determine Jerry's adjusted basis and holding period for the land and building.

Definitions:

Rotating Fault Blocks

geological structures that move around a vertical axis due to tectonic forces, altering the Earth's crust.

Layers Rotate

Geological process in which layers or strata of rock are tilted or turned from their original horizontal or vertical positions.

Basin and Range Province

A vast geographical area in the United States characterized by alternating basins and mountain ranges, formed by stretching of the Earth's crust.

Gulf Coast Region

A geographical area in the United States bordering the Gulf of Mexico, known for its warm climate, wetlands, and as an important area for energy production and shipping.

Q4: The holding period of property given up

Q22: Section 1231 property generally includes certain purchased

Q24: Under the percentage of completion method,if the

Q30: What effect do deductible gambling losses for

Q34: Dale owns and operates Dale's Emporium as

Q40: What incentives do the tax accounting rules

Q53: Barb borrowed $100,000 to acquire a parcel

Q63: Realized gain or loss is measured by

Q100: The amount of a corporate distribution qualifying

Q101: Broker's commissions,legal fees,and points paid by the