Multiple Choice

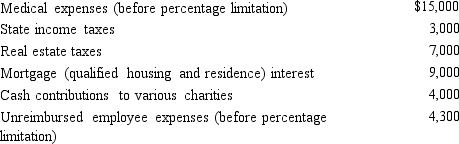

Mitch,who is single and age 66 and has no dependents,had AGI of $100,000 in 2014.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2014?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2014?

Definitions:

Related Questions

Q16: Individuals can deduct from active or portfolio

Q29: For each of the following involuntary conversions,determine

Q55: Karen owns City of Richmond bonds with

Q66: Emily,who lives in Indiana,volunteered to travel to

Q79: Sammy exchanges equipment used in his

Q85: Jackson Company incurs a $50,000 loss on

Q97: For regular income tax purposes,Yolanda,who is single,is

Q100: How does the replacement time period differ

Q110: The work-related expenses of an independent contractor

Q112: If Abby's alternative minimum taxable income exceeds