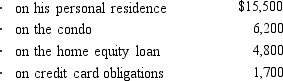

Ted,who is single,owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March 2014,he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During 2014,he paid the following amounts of interest:  What amount,if any,must Ted recognize as an AMT adjustment in 2014?

What amount,if any,must Ted recognize as an AMT adjustment in 2014?

Definitions:

Outstanding Deposits

Funds that have been deposited but not yet credited to the depositor's account or cleared by the bank.

Outstanding Checks

Unprocessed checks that have been written and deducted from an account's balance but not yet presented for payment or cleared.

Check Register

A record book or ledger that tracks all checks written, deposits made, and current balance for a checking account.

Cash Balance

The total amount of cash in a company's account at any given time.

Q5: Kelly,who earns a yearly salary of $120,000,sold

Q14: Manny,age 57,developed a severe heart condition,and his

Q21: The basis of personal use property converted

Q32: Which,if any,of the following is subject to

Q33: Residential rental real estate includes property where

Q35: Violet,Inc. ,has a 2014 $80,000 long-term capital

Q41: A worthless security had a holding period

Q45: Marvin,the vice president of Lavender,Inc. ,exercises stock

Q71: Evan is a contractor who constructs both

Q95: Treatment of an installment sale of a