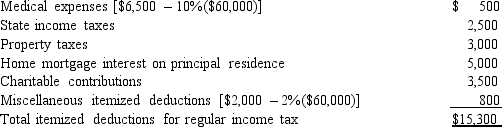

In calculating her 2014 taxable income,Rhonda,who is age 45,deducts the following itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Definitions:

Coffee Farmer

An individual or entity engaged in the cultivation and harvesting of coffee beans.

Profit Maximized

A condition in which a firm achieves the maximum possible profit given its production costs and market conditions, often determined by the intersection of marginal cost and marginal revenue.

Competitive Firm

A company operating in a market where it competes with other entities for market share and profits by offering the best possible mix of price and quality.

Profit Maximizing

The process or strategy undertaken by businesses to achieve the highest possible profit, often entailing decisions on pricing, production, and cost management.

Q3: The disabled access credit is computed at

Q23: Keosha acquires 10-year personal property to use

Q42: In May 2012,Swallow,Inc. ,issues options to Karrie,a

Q48: Richard,age 50,is employed as an actuary.For calendar

Q97: Upon the recommendation of a physician,Ed has

Q114: Land improvements are generally not eligible for

Q130: Joyce's office building was destroyed in a

Q137: Sue uses her own tools.<br>A)Indicates employee status.<br>B)Indicates

Q142: Alexis (a CPA)sold her public accounting practice

Q151: For tax purposes,"travel" is a broader classification