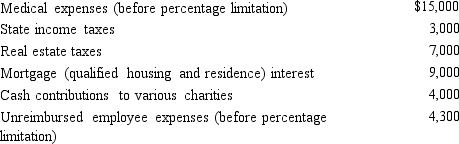

Mitch,who is single and age 66 and has no dependents,had AGI of $100,000 in 2014.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2014?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2014?

Definitions:

Offending Organization

An organization that engages in actions or behaviors that are unethical, illegal, or harmful to stakeholders.

Ethical Blind Spots

Areas or situations where individuals fail to recognize ethical issues or dilemmas, often due to cognitive biases.

Ethical Misconduct

Actions or behaviors by individuals or organizations that violate ethical norms or standards.

Conflicts of Interest

Situations where a person's private interests might interfere with their professional obligations or duties.

Q11: Carol had the following transactions during 2014:

Q21: The basis of personal use property converted

Q35: Pablo,who is single,has $95,000 of salary,$10,000 of

Q43: Antiques may be eligible for cost recovery

Q52: A taxpayer is considered to be a

Q67: Terry exchanges real estate (acquired on August

Q88: Betty owns a horse farm with 500

Q100: A taxpayer who maintains an office in

Q116: Abbygail,who is single,had taxable income of $115,000

Q146: Travel status requires that the taxpayer be