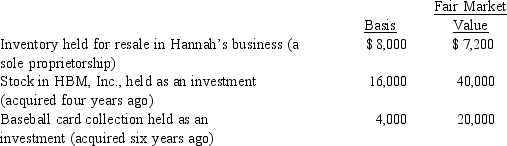

Hannah makes the following charitable donations in the current year:  The HBM stock and the inventory were given to Hannah's church,and the baseball card collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations,Hannah's current charitable contribution deduction is:

The HBM stock and the inventory were given to Hannah's church,and the baseball card collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations,Hannah's current charitable contribution deduction is:

Definitions:

Self-Concept

An individual’s perception of themselves, encompassing beliefs, feelings, and thoughts about one's abilities, appearance, and values.

Immobility

The lack of ability to move freely or easily, often as a result of a health condition or physical restraint.

Depression

A psychological condition marked by a continuous low mood or lack of enthusiasm for activities, leading to considerable disruption in everyday functioning.

Gait

The manner in which a person walks, including rhythm, speed, and stride length.

Q3: In 2013,the costs of qualified leasehold improvements

Q22: In May 2010,Cindy incurred qualifying rehabilitation expenditures

Q23: Marilyn owns 100% of the stock of

Q65: Lynn determines when the services are to

Q71: Why is it generally undesirable to pass

Q78: Sue files a Schedule SE with her

Q99: A taxpayer's earned income credit is dependent

Q108: Jenny spends 32 hours a week,50 weeks

Q137: Alice incurs qualified moving expenses of $12,000.If

Q147: A deduction for parking and other traffic