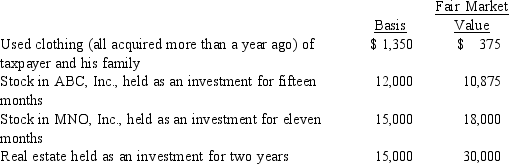

Zeke made the following donations to qualified charitable organizations during the year:  The used clothing was donated to the Salvation Army;the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for the year is:

The used clothing was donated to the Salvation Army;the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for the year is:

Definitions:

Quota Sampling

A type of sampling in which a certain number of participants are picked based on selection criteria such as demographics.

Snowball Sampling

A non-probability sampling technique where existing study subjects recruit future subjects from among their acquaintances.

Tea Preferences

Individual choices or inclinations towards different types of tea based on taste, aroma, or origin.

Surveyor

A professional involved in the measurement and description of land surfaces to determine boundaries, land areas, and the preparation of maps and documents.

Q13: Ahmad is considering making a $10,000 investment

Q16: Joe purchased a new five-year class asset

Q50: If a taxpayer purchases taxable bonds at

Q64: Arlene,who is single,has taxable income for

Q65: Lynn determines when the services are to

Q75: If the regular income tax deduction for

Q82: Jack and Jill are married,have three children,and

Q99: A taxpayer's earned income credit is dependent

Q116: Abbygail,who is single,had taxable income of $115,000

Q139: Aaron is a self-employed practical nurse who