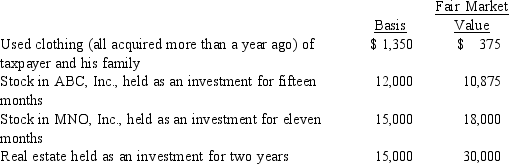

Zeke made the following donations to qualified charitable organizations during the year:  The used clothing was donated to the Salvation Army;the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for the year is:

The used clothing was donated to the Salvation Army;the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for the year is:

Definitions:

Consumption

The use of goods and services by households, involving the purchasing and utilization of commodities to satisfy needs and wants.

Specific Tax

A fixed amount imposed by the government on a product, service, or activity.

Price Elasticity

A measure that shows how much the quantity demanded of a good responds to a change in the price of that good.

Tax Borne

Refers to the entity (consumers, producers, or others) that ultimately pays the economic cost of a tax, regardless of who the tax is initially levied upon.

Q29: Describe the withholding requirements applicable to employers.

Q56: Jermaine and Kesha are married,file a joint

Q57: The earned income credit is available only

Q63: The AMT exemption for a C corporation

Q77: Under the right circumstances,a taxpayer's meals and

Q82: Joe,who is in the 33% tax bracket

Q108: Lavender,Inc. ,incurs research and experimental expenditures of

Q111: If personal casualty gains exceed personal casualty

Q122: Martha rents part of her personal residence

Q172: The § 222 deduction for tuition and