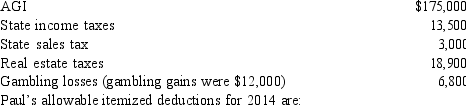

Paul,a calendar year married taxpayer,files a joint return for 2014.Information for 2014 includes the following:

Definitions:

Vulnerable

A state of being open to harm, damage, or emotional injury, often due to a lack of protection or support.

Survivor Effect

The phenomenon whereby individuals or entities that make it past a selection process or to a later point in time are not representative of the entire original population.

Mental Disorders

Conditions that affect an individual's thinking, feeling, behavior, or mood, significantly impacting daily life and functioning.

Q6: James purchased a new business asset (three-year

Q23: Adrienne sustained serious facial injuries in a

Q53: Kay had percentage depletion of $119,000 for

Q55: During the year,Purple Corporation (a U.S.Corporation)has U.S.-source

Q58: If an account receivable written off during

Q59: On October 2,2014,Ross quits his job with

Q66: Statutory employees:<br>A)Report their expenses on Form 2106.<br>B)Include

Q74: The phaseout of the AMT exemption amount

Q88: John owns and operates a real estate

Q102: The basis of an asset on which