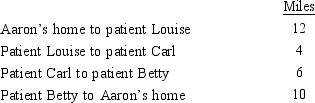

Aaron is a self-employed practical nurse who works out of his home.He provides nursing care for disabled persons living in their residences.During the day he drives his car as follows.  Aaron's deductible mileage for each workday is:

Aaron's deductible mileage for each workday is:

Definitions:

Canada's Divorce Act

The legal legislation governing divorce in Canada, outlining the grounds and procedures for legally ending a marriage.

Physical Cruelty

Actions that cause physical harm or suffering to others, including animals, often indicative of abuse or violence.

Living Apart

Refers to the lifestyle choice or circumstance where individuals in a relationship choose to maintain separate residences to preserve individual space, independence, or for logistical reasons.

Divorce Rate

A statistical rate that measures the number of divorces occurring among the population during a given year per 1,000 inhabitants.

Q6: Jed is an electrician.Jed and his wife

Q17: Rocky has a full-time job as an

Q42: On February 21,2014,Joe purchased new farm equipment

Q44: In distinguishing whether an activity is a

Q46: Due to a merger,Allison transfers from

Q61: Time test (for moving expenses)waived<br>A)Cover charge paid

Q68: Since most tax preferences are merely timing

Q74: The phaseout of the AMT exemption amount

Q114: Land improvements are generally not eligible for

Q133: Briefly discuss the disallowance of deductions for