After graduating from college,Clint obtained employment in Omaha.In moving from his parents' home in

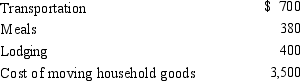

Baltimore to Omaha,Clint incurred the following expenses:

a.How much may Clint deduct as moving expense?

b.Would any deduction be allowed if Clint claimed the standard deduction for the year of the move? Explain.

Definitions:

Socially Responsible

Acting in a way that benefits society at large, considering the impact of one's actions on the welfare of others and the environment.

Plato

An ancient Greek philosopher, a student of Socrates, whose work laid the foundations for much of Western philosophy.

Beauty

The quality or combination of qualities in a person or thing that gives pleasure to the senses or deeply satisfies the mind.

Friedrich Schiller

A German poet, philosopher, physician, and playwright known for his works on aesthetics and human freedom.

Q5: George purchases used sevenyear class property at

Q20: Marvin lives with his family in Alabama.He

Q26: When qualified residence interest exceeds qualified housing

Q44: Eula owns a mineral property that had

Q48: The taxpayer incorrectly took a $5,000 deduction

Q85: Personal expenditures that are deductible as itemized

Q96: Generally,a closely-held family corporation is not permitted

Q141: Sue uses her own helpers.<br>A)Indicates employee status.<br>B)Indicates

Q153: Tax home has changed<br>A)Must involve the same

Q163: A taxpayer who lives and works in