Rocky has a full-time job as an electrical engineer for the city utility.In his spare time,Rocky repairs TV sets in the basement of his personal residence.Most of his business comes from friends and referrals from former customers,although occasionally he runs an ad in the local suburbia newspaper.Typically,the sets are dropped off at Rocky's house and later picked up by the owner when notified that the repairs have been made.

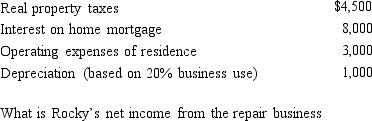

The floor space of Rocky's residence is 2,500 square feet,and he estimates that 20% of this is devoted exclusively to the repair business (i.e. ,500 square feet).Gross income from the business is $13,000,while expenses (other than home office)are $5,000.Expenses relating to the residence are as follows:

a.If he uses the regular (actual expense)method of computing the deduction for office in the home?

b.If he uses the simplified method?

Definitions:

Superstars

Individuals who achieve exceptional success and influence in their fields, often resulting in significant earnings or recognition.

High Incomes

Earnings that significantly exceed the average or median levels, often associated with increased purchasing power and economic status.

Efficiency Wages

Wages that are deliberately set above the market equilibrium level to increase worker productivity and efficiency.

Employee Effort

The level of exertion, both physical and mental, that workers contribute to their job tasks to achieve organizational goals.

Q20: Marvin lives with his family in Alabama.He

Q35: Three years ago,Sharon loaned her sister $30,000

Q49: Al contributed a painting to the Metropolitan

Q54: The amount of the deduction for medical

Q63: Paul and Patty Black (both are age

Q64: The amount of a loss on insured

Q67: Alfred's Enterprises,an unincorporated entity,pays employee salaries of

Q90: Only some employment related expenses are classified

Q102: After personal property is fully depreciated for

Q115: Which of the following is a deduction