After graduating from college,Clint obtained employment in Omaha.In moving from his parents' home in

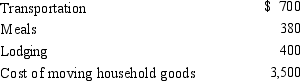

Baltimore to Omaha,Clint incurred the following expenses:

a.How much may Clint deduct as moving expense?

b.Would any deduction be allowed if Clint claimed the standard deduction for the year of the move? Explain.

Definitions:

Q27: The amount of a farming loss cannot

Q38: Alicia was involved in an automobile accident

Q47: During the year,Eve (a resident of Billings,Montana)spends

Q53: Kay had percentage depletion of $119,000 for

Q58: Sage,Inc. ,has the following gross receipts and

Q71: On February 20,2014,Susan paid $200,000 for a

Q73: Brad,who uses the cash method of accounting,lives

Q78: Ross,who is single,purchased a personal residence eight

Q83: Maria,who is single,had the following items for

Q107: In June,Della purchases a building for $800,000