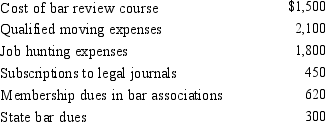

In the current year,Bo accepted employment with a Kansas City law firm after graduating from law school.Her expenses for the year are listed below:

Since Bo worked just part of the year,her salary was only $32,100.In terms of deductions from AGI,how much does Bo have?

Since Bo worked just part of the year,her salary was only $32,100.In terms of deductions from AGI,how much does Bo have?

Definitions:

Transparency

The quality of being easily seen through or understood, often used metaphorically to describe openness and honesty in operations or intentions.

Openness

The willingness to share ideas and information freely, and to be receptive to new experiences and diverse perspectives.

Minimize Distractions

Efforts made to reduce or eliminate factors that divert attention from the task at hand.

Short Text Messages

Brief written messages, typically sent via mobile phones or online platforms, used for quick communication.

Q34: Bridgett's son,Clyde,is $12,000 in arrears on his

Q43: Tonya had the following items for last

Q48: The taxpayer incorrectly took a $5,000 deduction

Q49: The ceiling amounts and percentages for 2014

Q49: Joel placed real property in service in

Q54: The amount of the deduction for medical

Q79: Active participation.<br>A)Taxpayer devotes time aggregating more than

Q99: LD Partnership,a cash basis taxpayer,purchases land and

Q126: Qualified moving expenses include the cost of

Q126: During the year,Jim rented his vacation home