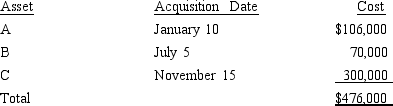

Audra acquires the following new five-year class property in 2014:

Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction.Audra does not take additional first-year depreciation (if available).Determine her total cost recovery deduction (including the § 179 deduction)for the year.

Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction.Audra does not take additional first-year depreciation (if available).Determine her total cost recovery deduction (including the § 179 deduction)for the year.

Definitions:

Initial Episode

The first occurrence or manifestation of a situation, condition, or series of events.

Permanent

Having the quality of lasting indefinitely without change or decay.

Research

systematic investigation and study of materials and sources to establish facts and reach new conclusions.

Adolescence

The transitional stage from childhood to adulthood that includes physical, psychological, and social changes.

Q30: Discuss the tax consequences of listed property

Q31: In 2014,Theresa was in an automobile accident

Q34: On August 20,2013,May signed a 10-year lease

Q54: After completing an overseas assignment in Oslo

Q57: MACRS depreciation is used to compute earnings

Q57: Matt has three passive activities and

Q65: Carlos purchased an apartment building on November

Q81: In all community property states,the income from

Q110: Nora,single,had the following income and deductions for

Q118: Jim had a car accident in 2014