Essay

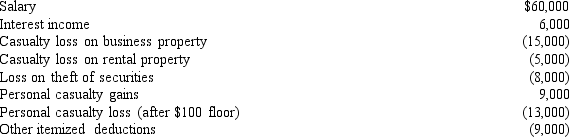

Juanita,single and age 43,had the following items for 2014:

Compute Juanita's taxable income for 2014.

Compute Juanita's taxable income for 2014.

Understand the theoretical perspectives relevant to depression including biological, cognitive, and psychoanalytic theories.

Identify common treatments for depression from a psychiatric point of view.

Recognize the role of neurotransmitters in the mood disorders.

Distinguish between different factors contributing to depression such as self-defeating thoughts, gender differences, and biochemical causes.

Definitions:

Related Questions

Q29: In order to protect against rent increases

Q33: Roger is in the 35% marginal tax

Q43: During 2014,Kathy,who is self-employed,paid $650 per month

Q52: Joseph and Sandra,married taxpayers,took out a mortgage

Q59: A theft loss of investment property is

Q64: Norm purchases a new sports utility vehicle

Q88: Janet is the CEO for Silver,Inc. ,a

Q89: Noah moved from Delaware to Arizona to

Q93: Nicole just retired as a partner in

Q154: Ralph made the following business gifts during