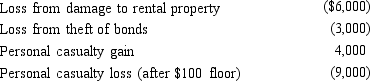

In 2014,Morley,a single taxpayer,had an AGI of $30,000 before considering the following items:  Determine the amount of Morley's itemized deduction from the losses.

Determine the amount of Morley's itemized deduction from the losses.

Definitions:

Lineages

Sequences of species that are descended from a common ancestor, reflecting the evolutionary history of the species.

Bryozoan Lineages

The evolutionary branches representing the diverse groups within the Bryozoa phylum, small aquatic invertebrate animals.

Modern Fauna

Refers to the animal species that inhabit the Earth during the current geological time period, known as the Holocene.

Carbon Dioxide

A colorless, odorless gas produced by burning carbon and organic compounds and by respiration. It is naturally present in the air and absorbed by plants in photosynthesis.

Q5: The earnings from a qualified state tuition

Q29: Sarah,a widow,is retired and receives $20,000 interest

Q71: Madison and Christopher are staff accountants at

Q89: Discuss the treatment,including the carryback and carryforward

Q99: On July 17,2014,Kevin places in service a

Q105: Wayne owns a 30% interest in the

Q108: Meredith holds two jobs and attends graduate

Q123: Max opened his dental practice (a sole

Q125: Petula's business sells heat pumps which have

Q172: The § 222 deduction for tuition and