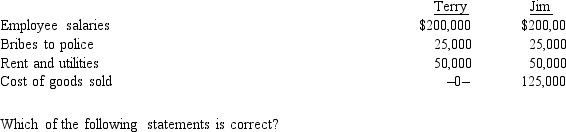

Terry and Jim are both involved in operating illegal businesses.Terry operates a gambling business and Jim operates a drug running business.Both businesses have gross revenues of $500,000.The businesses incur the following expenses.

Definitions:

Q7: On April 15,2014,Sam placed in service a

Q31: In 2014,Theresa was in an automobile accident

Q34: Kristen's employer owns its building and provides

Q44: Rachel,who is in the 35% marginal tax

Q45: Nonbusiness income for net operating loss purposes

Q52: Gordon,an employee,is provided group term life insurance

Q53: In applying the gross income test in

Q67: Surviving spouse<br>A)Not available to 65-year old taxpayer

Q94: If a taxpayer can satisfy the three-out-of-five

Q119: Tracy,the regional sales director for a manufacturer