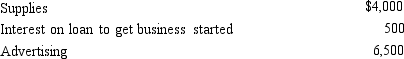

Priscella pursued a hobby of making bedspreads in her spare time.Her AGI before considering the hobby is $40,000.During the year she sold the bedspreads for $10,000.She incurred expenses as follows:  Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

Definitions:

State Field

A component of a database or form that captures information related to the state or condition of an item or entity.

Property Box

A dialog box in software applications where users can view and modify settings and characteristics of selected elements or objects.

SQL Server

A relational database management system developed by Microsoft, designed to store, retrieve, and manage structured data.

Resources Needed Field

A specific area or field in a document or software where information about required resources is entered or displayed.

Q22: Deductions for AGI are often referred to

Q43: Can a trade or business expense be

Q50: Briefly explain why interest on money borrowed

Q53: Cora purchased a hotel building on May

Q57: At age 65,Camilla retires from her job

Q76: Gain on collectibles (held more than one

Q77: Mark a calendar year taxpayer,purchased an annuity

Q125: Petula's business sells heat pumps which have

Q155: A decrease in a taxpayer's AGI could

Q167: If a taxpayer does not own a