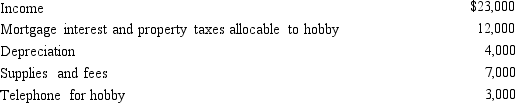

Calculate the net income includible in taxable income for the following hobby:

Definitions:

Corporate Form

A legal structure for businesses recognized as separate entities from their owners, providing limited liability protection and enabling easier access to capital.

Cost Efficient

Achieving a specific goal or output with minimum expense or least waste.

Economic Profit

The discrepancy between sum revenue and sum expenses, taking into account both acknowledged and assumed costs.

Principal-Agent Problem

A dilemma in relationships when one party (the agent) is expected to act in the best interest of another (the principal), but has the potential to act in their own self-interest instead.

Q1: If a taxpayer sells their § 1244

Q6: The portion of property tax on a

Q10: The taxpayer is a Ph.D.student in accounting

Q20: Which of the following are deductions for

Q41: During 2013,the first year of operations,Silver,Inc. ,pays

Q61: Derek,age 46,is a surviving spouse.If he has

Q90: Nelda is married to Chad,who abandoned her

Q97: Roger,an individual,owns a proprietorship called Green Thing.For

Q97: Sue has unreimbursed expenses.<br>A)Indicates employee status.<br>B)Indicates independent

Q184: Emily,whose husband died in December 2013,maintains a