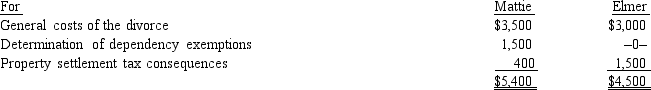

Mattie and Elmer are separated and are in the process of obtaining a divorce.They incur legal fees for their respective attorneys with the expenses being itemized as follows:

Although there is no requirement that he do so,Elmer pays Mattie's lawyer as a gesture of the positive feelings he still has for her.

Although there is no requirement that he do so,Elmer pays Mattie's lawyer as a gesture of the positive feelings he still has for her.

a.Determine the deductions for Mattie and for Elmer.

b.Classify the deductions as for AGI and from AGI.

Definitions:

Cents

A monetary unit in various countries, equal to one-hundredth of a base unit of currency, like the dollar in the United States.

Aluminum Tubing

Hollow cylindrical pieces made of aluminum used in various applications, including construction and manufacturing.

Feet

A unit of length in the imperial and US customary systems of measurement, equal to 12 inches or 0.3048 meters.

Costs

Expenses incurred in the process of producing or acquiring goods and services.

Q8: A taxpayer who claims the standard deduction

Q25: Are there any exceptions to the rule

Q47: Gary cashed in an insurance policy on

Q50: Travis and Andrea were divorced.Their only marital

Q56: Howard's business is raising and harvesting peaches.On

Q59: A theft loss of investment property is

Q82: For a vacation home to be classified

Q88: How does the taxation of Social Security

Q123: Turner,Inc. ,provides group term life insurance to

Q133: Which,if any,of the statements regarding the standard