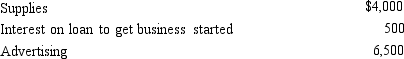

Priscella pursued a hobby of making bedspreads in her spare time.Her AGI before considering the hobby is $40,000.During the year she sold the bedspreads for $10,000.She incurred expenses as follows:  Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

Definitions:

Attitudinal Outcomes

Refers to the impacts on or changes in an individual's attitudes, beliefs, or perceptions resulting from an experience or intervention.

Call-To-Action

A prompt or instruction within marketing material aimed at inducing the audience to take a desired action.

Cost Per Click

A digital advertising metric that measures the amount paid for each click on an ad, indicating the cost of directing a user to a website or landing page.

Advertiser

An individual or company that pays to promote their product, service, or brand through various forms of media.

Q12: Abandoned spouse<br>A)Not available to 65-year old taxpayer

Q22: Discuss the criteria used to determine whether

Q49: A taxpayer should always minimize his or

Q59: Graham,a CPA,has submitted a proposal to do

Q63: Betty purchased an annuity for $24,000 in

Q69: Actual cost method of determining car expense<br>A)Cover

Q102: Alimony recapture may occur if there is

Q108: Meredith holds two jobs and attends graduate

Q131: A taxpayer who uses the automatic mileage

Q181: Perry is in the 33% tax