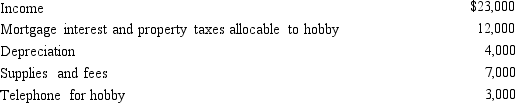

Calculate the net income includible in taxable income for the following hobby:

Definitions:

Personal Use

The use of property or resources for individual needs or activities not related to business or profit-making.

Schedule C

Schedule C is a tax form used by sole proprietors to report their business income and expenses to the IRS.

Schedule E

Used by taxpayers to report income and losses from rental property, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

Royalty Income

Income derived from the use of an individual’s or entity's property, such as patents, copyrighted works, or natural resources.

Q9: During the year,Rita rented her vacation home

Q11: Why are there restrictions on the recognition

Q19: Gold Company was experiencing financial difficulties,but was

Q32: James,a cash basis taxpayer,received the following compensation

Q43: Peggy is an executive for the Tan

Q96: Iris collected $150,000 on her deceased husband's

Q110: When married persons file a joint return,joint

Q112: The factor for determining the cost recovery

Q141: The cash method can be used even

Q167: If a taxpayer does not own a